A manufacturing company prepays its insurance coverage for a three-year period

A manufacturing company prepays its insurance coverage for a three-year period. The premium for the three years is $3,600 and is paid at the beginning of the first year. Eighty percent of the premium applies to manufacturing operations and twenty percent applies to selling and administrative activities. What amounts should be considered product and period costs respectively for the first year of coverage?

Product

Period

A$3,600

$0

B$2,880

$720

C$1,920

$480

D$960

$240

2. At an activity level of 8,600 machine-hours in a month, Nooner Corporation’s total variable production engineering cost is $734,440 and its total fixed production engineering cost is $154,000. What would be the total production engineering cost per unit, both fixed and variable, at an activity level of 8,800 machine-hours in a month? Assume that this level of activity is within the relevant range. (Do not round intermediate calculations.)

A$102.90

B$102.01

C$102.55

D$103.08

3.Buckeye Company has provided the following data for maintenance cost:

Prior Year

Current Year

Machine hours

18,500

21,100

Maintenance cost

$30,500

$34,140

Maintenance cost is a mixed cost with variable and fixed components. The fixed and variable components of maintenance cost are closest to:

A.$30,500 per year plus $1.40 per machine hour

B$29,540 per year plus $.714 per machine hour

C$4,600 per year plus $.714 per machine hour

D$4,600 per year plus $1.40 per machine hour

4.A soft drink bottler incurred the following factory utility cost: $3,436 for 1,050 cases bottled and $3,548 for 1,700 cases bottled. Factory utility cost is a mixed cost containing both fixed and variable components. The variable factory utility cost per case bottled is closest to:

A$3.27

B$0.17

C$2.09

D$2.02

5. Supply costs at Lattea Corporation’s chain of gyms are listed below:

Client-Visits

Supply Cost

March

11,662

$28,576

April

11,458

$28,410

May

11,990

$28,834

June

13,500

$28,922

July

11,722

$28,637

August

11,208

$28,236

September

12,002

$28,835

October

11,693

$28,593

November

11,841

$28,718

Management believes that supply cost is a mixed cost that depends on client-visits. Use the high-low method to estimate the variable and fixed components of this cost, Compute the variable component first, rounding off to the nearest whole cent. Then compute the fixed component, rounding off to the nearest whole dollar. Those estimates would be closest to: (Round your Variable cost per unit to 2 decimal places.)

A$1.99 per client-visit; $28,638 per month

B$.88 per client-visit; $17,814 per month

C$0.34 per client-visit; $24,367 per month

D$0.30 per client-visit; $24,872 per month

6.Babuca Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.

Production volume

10,500

units

12,000

units

Direct materials

$647,850

$740,400

Direct labor

$183,750

$210,000

Manufacturing overhead

$1,009,000

$1,026,850

The best estimate of the total monthly fixed manufacturing cost is: (Do not round intermediate calculations.)

A$891,550

B$884,050

C$881,050

D$887,050

Bottom of Form

7.Babuca Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.

Production volume

10,500

units

12,000

units

Direct materials

$647,850

$740,400

Direct labor

$183,750

$210,000

Manufacturing overhead

$1,009,000

$1,026,850

The best estimate of the total monthly fixed manufacturing cost is: (Do not round intermediate calculations.)

A$881,050

B$891,550

C$884,050

D$887,050

8.Nikkel Corporation, a merchandising company, reported the following results for July:

Sales

$419,000

Cost of goods sold (all variable)

$175,500

Total variable selling expense

$23,600

Total fixed selling expense

$17,200

Total variable administrative expense

$15,400

Total fixed administrative expense

$31,400

The gross margin for July is:

A$204,500

B$370,400

C$243,500

D$155,900

9. Nikkel Corporation, a merchandising company, reported the following results for July:

Sales

$447,000

Cost of goods sold (all variable)

$170,500

Total variable selling expense

$20,100

Total fixed selling expense

$21,600

Total variable administrative expense

$8,500

Total fixed administrative expense

$31,300

The contribution margin for July is:

A$276,500

B$394,100

C$195,000

D$247,900

10. Salvadore Inc., a local retailer, has provided the following data for the month of September:

Merchandise inventory, beginning balance

$ 42,700

Merchandise inventory, ending balance

$ 42,400

Sales

$261,700

Purchases of merchandise inventory

$138,500

Selling expense

$ 16,900

Administrative expense

$ 61,000

The net operating income for September was:

A$45,000

B$123,200

C$53,200

D$124,200

11. Lettman Corporation has provided the following partial listing of costs incurred during November:

Marketing salaries

$

52,900

Property taxes, factory

$

9,200

Administrative travel

$

104,500

Sales commissions

$

51,200

Indirect labor

$

44,400

Direct materials

$

171,900

Advertising

$

147,400

Depreciation of production equipment

$

42,000

Direct labor

$

90,900

Required:

a.

What is the total amount of product cost listed above?

b.

What is the total amount of period cost listed above?

12. Corio Corporation reports that at an activity level of 4,400 units, its total variable cost is $283,096 and its total fixed cost is $136,710.

Required:

For the activity level of 4,500 units, compute: (a) the total variable cost; (b) the total fixed cost; (c) the total cost; (d) the average variable cost per unit; (e) the average fixed cost per unit; and (f) the average total cost per unit. Assume that this activity level is within the relevant range. (Round your “Average cost” to 2 decimal places and other answers to the nearest dollar amount.)

(a)Total variable cost$ (b)Total fixed cost$ (c)Total cost$ (d)Average variable cost$ per unit (e)Average fixed cost$ per unit (f)Average total cost$ per unit

13. Dagger Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the total estimated manufacturing overhead was $254,900. At the end of the year, actual direct labor-hours for the year were 18,500 hours, manufacturing overhead for the year was underapplied by $16,800, and the actual manufacturing overhead was $249,900. The predetermined overhead rate for the year must have been closest to:

14. Cribb Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor-hours were 10,500 hours and the total estimated manufacturing overhead was $228,900. At the end of the year, actual direct labor-hours for the year were 9,700 hours and the actual manufacturing overhead for the year was $206,840. Overhead at the end of the year was: (Round your intermediate calculations to 2 decimal places.)

15. At the beginning of the year, manufacturing overhead for the year was estimated to be $279,720. At the end of the year, actual direct labor-hours for the year were 22,700 hours, the actual manufacturing overhead for the year was $270,500, and manufacturing overhead for the year was overapplied by $15,520. If the predetermined overhead rate is based on direct labor-hours, then the estimated direct labor-hours at the beginning of the year used in the predetermined overhead rate must have been: (Round your intermediate calculations to 2 decimal places.)

16. Job 593 was recently completed. The following data have been recorded on its job cost sheet:

Direct materials$2,429 Direct labor-hours74 labor-hours Direct labor wage rate$ 17 per labor-hour Machine-hours135 machine-hours

The Corporation applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $18 per machine-hour. The total cost that would be recorded on the job cost sheet for Job 593 would be:

17. The following data have been recorded for recently completed Job 323 on its job cost sheet. Direct materials cost was $2,063. A total of 33 direct labor-hours and 234 machine-hours were worked on the job. The direct labor wage rate is $18 per labor-hour. The Corporation applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $24 per machine-hour. The total cost for the job on its job cost sheet would be:

18. During October, Dorinirl Corporation incurred $68,500 of direct labor costs and $4,800 of indirect labor costs. The journal entry to record the accrual of these wages would include a:

19. Soledad Corporation had $30,600 of raw materials on hand on December 1. During the month, the Corporation purchased an additional $76,500 of raw materials. The journal entry to record the purchase of raw materials would include a:

20. During October, Beidleman Inc. transferred $63,600 from Work in Process to Finished Goods and recorded a Cost of Goods Sold of $69,120. The journal entries to record these transactions would include a:

21. Bretthauer Corporation has provided data concerning the Corporation’s Manufacturing Overhead account for the month of July. Prior to the closing of the overapplied or underapplied balance to Cost of Goods Sold, the total of the debits to the Manufacturing Overhead account was $39,000 and the total of the credits to the account was $47,000. Which of the following statements is true?

22. Compute the amount of raw materials used during August if $23,000 of raw materials were purchased during the month and the inventories were as follows:

InventoriesBalance August 1Balance August 31 Raw materials$1,600 $3,300 Work in process$9,000 $14,000 Finished goods$33,000 $33,000

23. Cerrone Inc. has provided the following data for the month of July. The balance in the Finished Goods inventory account at the beginning of the month was $57,000 and at the end of the month was $49,400. The cost of goods manufactured for the month was $301,000. The actual manufacturing overhead cost incurred was $153,500 and the manufacturing overhead cost applied to Work in Process was $142,000. The adjusted cost of goods sold that would appear on the income statement for July is:

24. Baker Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $73,140 and 2,300 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $75,290 and actual direct labor-hours were 2,200.

The applied manufacturing overhead for the year was closest to: (Round your intermediate calculations to 2 decimal places.)

25-26. [The following information applies to the questions displayed below.]

Meyers Corporation had the following inventory balances at the beginning and end of November:

November 1 November 30

Raw Materials $24,000 $18,000

Finished Goods $66,000 $45,000

Work in Process $9,000 $15,000

During November, $51,000 in raw materials (all direct materials) were drawn from inventory and used in production. The company’s predetermined overhead rate was $6 per direct labor-hour, and it paid its direct labor workers $9 per hour. A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account. The ending Work in Process inventory account contained $6,000 of direct materials cost. The Corporation incurred $36,000 of actual manufacturing overhead cost during the month and applied $33,000 in manufacturing overhead cost.

25.Required information

The direct materials cost in the November 1 Work in Process inventory account totaled:

26.Required information

The actual direct labor-hours worked during November totaled: (Round your answers to the nearest dollar.)

27. During February, Irving Corporation incurred $93,000 of actual Manufacturing Overhead costs. During the same period, the Manufacturing Overhead applied to Work in Process was $88,000.The journal entry to record the incurrence of the actual Manufacturing Overhead costs would include a:

28. During February, Irving Corporation incurred $90,000 of actual Manufacturing Overhead costs. During the same period, the Manufacturing Overhead applied to Work in Process was $86,000.The journal entry to record the application of Manufacturing Overhead to Work in Process would include a:

29. Quark Spy Equipment manufactures espionage equipment. Quark uses a job-order costing system and applies overhead to jobs on the basis of direct labor-hours. For the current year, Quark estimated that it would work 180,000 direct labor-hours and incur $38,520,000 of manufacturing overhead cost. The following summarized information relates to January of the current year. The raw materials purchased include both direct and indirect materials.

Raw materials purchased on account$2,719,200 Direct materials requisitioned into production$2,503,600 Indirect materials requisitioned into production$190,000 Direct labor cost (15,100 hours @ $32 per hour)$483,200 Indirect labor cost (15,900 hours @ $21 per hour)$333,900 Depreciation on the factory building$389,800 Depreciation on the factory equipment$1,822,700 Utilities for the factory$163,800 Cost of jobs finished$5,133,700 Cost of jobs sold$4,899,500 Sales (all on account)$7,350,200

Required:

Prepare journal entries to record Quark’s transactions for the month of January. Do not close out the manufacturing overhead account. (Omit $ sign in your response.)

General JournalDebitCredita.

b.

c.

d.

e.

f.

g.

h.

i.

j.

30. Job 231 was recently completed. The following data have been recorded on its job cost sheet:

Direct materials$49,000 Direct labor-hours650 labor-hours Direct labor wage rate$13 per labor-hour Machine-hours390 machine-hours Number of units completed3,000 unitsThe company applies manufacturing overhead on the basis of machine-hours. The predetermined

overhead rate is $11 per machine-hour.Required:Compute the unit product cost that would appear on the job cost sheet for this job. (Round your answer to 2 decimal places. Omit the “$” sign in your response.) Unit product cost$

31. Schoff Corporation has provided the following data for the most recent month:

(PLEASE SHOW ME THE WHOLE T-ACCOUNT)

Raw materials, beginning balance$10,000 Work in process, beginning balance$22,000 Finished goods, beginning balance$52,300

Transactions(1)Raw materials purchases$75,300 (2)

Raw materials used in production (all direct materials)

$78,400 (3)

Direct labor

$72,300 (4)Manufacturing overhead costs incurred$82,300 (5)

Manufacturing overhead applied

$76,300 (6)Cost of units completed and transferred from work in process to finished goods$234,000 (7)Any overapplied or underapplied manufacturing overhead is closed to cost of goods sold?(8)Finished goods are sold$260,000

Required:

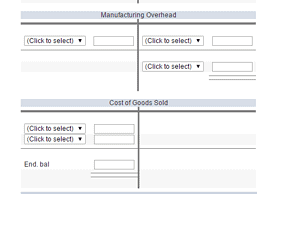

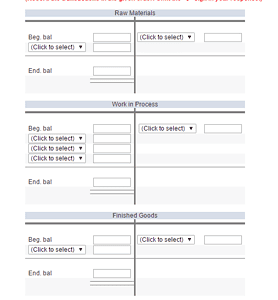

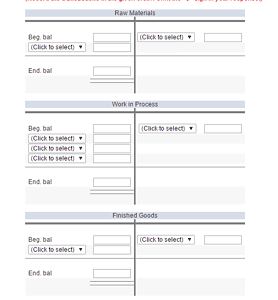

Prepare T-accounts for Raw Materials, Work in Process, Finished Goods, Manufacturing Overhead, and Cost of Goods Sold. Record the beginning balances and each of the transactions listed above. Finally, determine the ending balances. (Record the transactions in the given order. Omit the “$” sign in your response.)

…………………………….Answer preview…………………………….

1. A manufacturing company prepays its insurance coverage for a three-year period. The premium for the three years is $3,600 and is paid at the beginning of the first year. Eighty percent of the premium applies to manufacturing operations and twenty percent applies to selling and administrative activities. What amounts should be considered product and period costs respectively for the first year of coverage?

Product Period

A$3,600 $0B$2,880 $720

C$1,920 $480D$960 $240

Product cost = (36000*1/3*0.8) = 960

Period cost = (36000*1/3*0.2) = 240

d- is correct…………………..

APA

3012 words