Dwight Donovan the president of Donovan Enterprises is considering two investment opportunities.

Read the scenario:

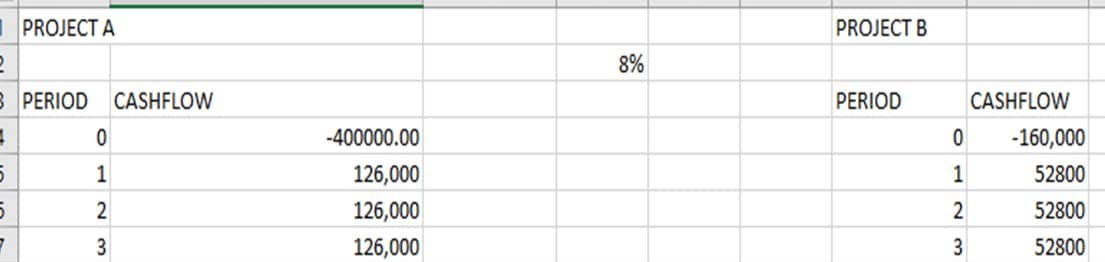

Dwight Donovan the president of Donovan Enterprises is considering two investment opportunities. Because of the limited resources, he will only be able to invest in one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for project A are $400,000 and for Project, B is $160,000. The Annual expected cash inflows are 126,000 for project A and $52,800 for project B. Both investments are expected to provide cash flow benefits for the next four years. Donovan Enterprises desired rate of return of 8 percent

Use Microsoft® Excel®—showing all work and formulas—to compute the following:

Compute the net present value of each project. Round your computations to 2 decimal points.

Compute the approximate internal rate of return for each project. Round your rates to 6 decimal points

Create a PowerPoint® presentation showing the comparison of the net present value approach with the internal rate of return approach calculated above. Complete the following in your presentation:

Analyze the results of the net present value calculations and the significance of these results, supported with examples.

Determine which project should be adopted based on the net present value approach and provide a rationale for your decision.

Analyze the results of the internal rate of return calculation and the significance of these results, supported with examples.

Determine which project should be adopted based on the internal rate of return approach and provide a rationale for your decision.

Determine the preferred method in the given circumstances and provide reasoning and details to support the method selected.

Synthesize results of analyses and computations to determine the best investment opportunity to recommend to the president of Donovan Enterprises.

Cite references to support your assignment.

Format your citations according to APA guidelines.

Submit the Excel spreadsheet along with the presentation.

Answer preview to Dwight Donovan the president of Donovan Enterprises is considering two investment opportunities.

6 slides